|

|

|

|

|

|

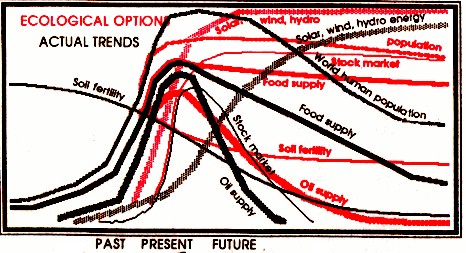

Stock Market Long Range Forecast by Paul Glover, HOUR Town, December 1997 Since 1994, when NAFTA was signed and the U.S. stock market reached 3800, this writer has predicted that the stock market would pass 10,000 and keep right on going, for at least five years beyond. This is because NAFTA (promoting North American goods transfer) and GATT (for global goods transfer) and MAI (for global investment) are dissolving barriers to the movement of money and goods. National laws prohibiting exploitation of labor (especially children), restricting corporate pollution of nature, protecting endangered animals, or restraining monopoly control, are being overruled by new global agencies (like the World Trade Organization). Thus, precious forests, animals, rivers, fertile soil, fuels, and human lives are now dirt cheap. Therefore, stock market downturns of 5% or 10%, or even 20%, merely reveal major investors burping before the next meal. Their feast can expand until earth's natural resources-the foundation of business-are so severely consumed that production begins to shrink. Within 20 years, global oil reserves will fall short of even modest economic expansion, despite new exploration and drilling technology. Even before then, wherever population growth collides with limited resources (especially food), there will be widespread nonviolent revolutions (like HOURS) and violent revolutions (like riots). Control of legislatures, armies and media makes transnational corporations resilient enough (in the short run) to profit from catastrophes, like global warming, and to transfer weapons and money to confront rebellions, thus to extend their tenure. This paper predicted (February 1992) that the United States would gradually become a Third World nation. Since then, shredding of the social safety net and the decline of the Middle Class have moved the U.S toward the bottom rank among industrial nations for health security, for fair wealth distribution, for domestic supply of natural resources, and other indicators of a stable economy. |

At that time we also predicted that, since "Russia has fabulous mineral wealth, forests, oil and natural gas" it "might become one of the world's great entrepreneurial powers. And we may see Japan's sun set, when aggressive nations change the rules of commerce, seizing Japan's assets." Russia is still reorganizing itself for coherent market extraction. But the recent threatened closure of U.S ports to Japanese shipping reminds us that stock assets are just paper, while military power trumps law. Eventually though, without the expansion of a Mutual Enterprise economy responsible to communities and nature (like HOURS), this present boom will bust, creating a Greater Depression than that of the 1930's. Sixty years ago nearly half the U.S. population lived on farms, so could grow their own food. Now 80% are urban, with little access to land or tools. Back then, most people lived in stable neighborhoods, so the poor could rely on one another for child care, for second-hand clothes, for barter, or for help when sick. Now, fewer neighbors know or care about one another. Like we said in 1992, "None of the above are good changes. To avoid cycles of gluttony, war and collapse, all nations could develop environ-mentally efficient locally-controlled economies." As this writer stated in The Economist (8/2/97): "HOURS are cash that's created by working people rather than capital markets. HOURS are real money, based on the community labor standard. Local credits might revive the national funny money that is so mired in the debt standard. And HOURS could even benefit macroeconomies, the stability of whose money depends ultimately upon the stability and vigor of village economies." To insulate ourselves from global boom and bust, we can INVEST IN COMMUNITY MARKETS for ourselves and our kids, by shopping with local craftspersons, businesses and farmers, by recycling, bicycling,and by supporting labor unions, trading local currency, having one or fewer children. The longrange economic forecast depends on us. |